Scottie Resources Advances Acquisition of Strategic Land Position in BC’s Golden Triangle

Scottie Resources Advances Acquisition of Strategic Land Position in BC’s Golden Triangle

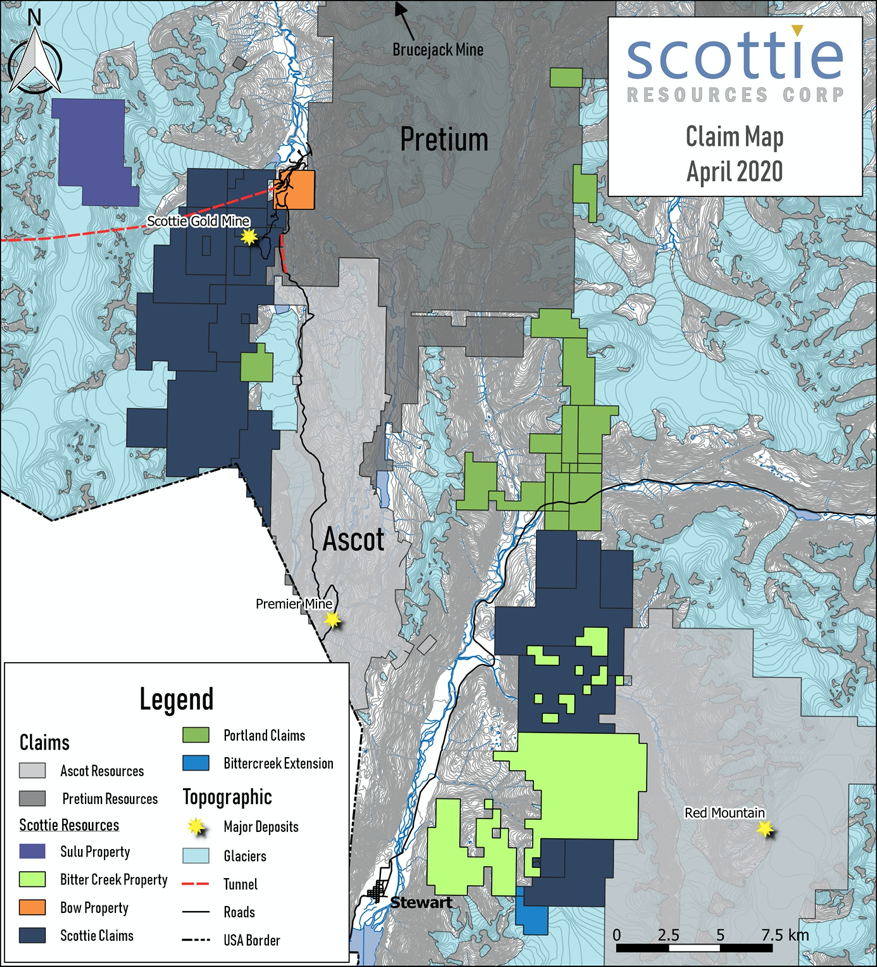

Vancouver, British Columbia, April 16, 2020 – Scottie Resources Corp. (“Scottie” or the “Company”) (TSXV: SCOT) is pleased to report on a number of recent property transactions and option agreement negotiations. Together these transactions increase the total claim package from 19,113 ha to 24,589 ha, decrease the percentage of optioned claims from 36% to 6.4%, and generate a total cumulative savings over the next 3 years of greater than $1 million CAD. All claims are located within the southern portion of British Columbia’s Golden Triangle, including the 100% owned Scottie Gold Mine which produced 95,426 oz at an average recovered grade of 16.25 g/t gold in the early 1980’s. The road accessible Scottie Gold Mine is located 20 km south of Pretium’s Brucejack Mine, and 14 km north of Ascot’s Premier Mine.

Table 1 – Summary of changes in land positions in early 2020

|

Property |

Change |

Outcome |

Cost (CAD) |

Savings (CAD) |

Hectares |

|

Bow Property |

Renegotiation of option agreement |

100% Ownership |

$300,000 |

$100,000 |

472 |

|

Bitter Creek Property |

Renegotiation of option agreement |

100% Ownership |

$325,000 & 1,000,000 shares |

$956,787* |

4,832 |

|

Portland Claims |

New purchase |

100% Ownership |

n/a |

3,622 |

|

|

Black Hills Extension |

Staked |

100% Ownership |

$1,575 |

n/a |

235 |

|

Sulu Property |

Staked |

100% Ownership |

$2,830 |

n/a |

1,617 |

|

Total |

$629,405 |

$1,056,787 |

10,778 |

||

*Savings includes both direct option payments ($665,000) as well as required work commitments ($291,787) over the life of the original option agreement.

Bradley Rourke, President and CEO of Scottie Resources commented: “Given Scottie’s existing land package, healthy treasury, and the recent momentum following upon our successful fall drill results – consolidation within the area is both natural and advantageous for us. The facilitation of these recent transactions increases our land package in a very tough area to acquire land, while simultaneously reducing our ongoing cash payments. These deals only reinforce our perspective that now is an excellent time to get business done.”

Bow Property –

The Bow property hosts two of the targets from the exceptionally successful 2019 drill program, which produced intercepts of 73.32 g/t gold over 4.38 metres on the Bend Vein, and 7.44 g/t gold over 34.78 metres on the Blueberry Vein. Exploration plans for 2020 include follow up drilling on both targets. To complete the original option agreement, Scottie was required to make two more payments during 2020 totalling $400,000. Re-negotiation of the agreement granted an expedited one-time payment of $300,000 – achieving a savings of $100,000. The property is now 100% owned by Scottie Resources, subject to a pre-existing 3% net smelter return (“NSR”), of which the Company can purchase 2% for $600,000.

Figure 1 – Updated Claim Map for Scottie Resources (April 2020)

Bitter Creek / Portland Claims / Black Hills Extension –

The Cambria Project consists of a large package of properties located just a few kilometers west of the town of Stewart, BC, which extend north for 25 km (Figure 1). The north-south swath of claims overlies a well-endowed mineral trend and is bordered to the east by Ascot Resources’ Red Mountain project. Together the claims host approximately 40 showings, including 2 small past-producers. The claim history in the area is complex and characteristically fragmental; the Cambria Project land package represents one of the largest consolidations of claims in this area over the past few decades. The mineral occurrences primarily occur as high-grade polymetallic veins, dominated by Ag-Pb-Zn±Au mineralization. The Cambria Project is a target-rich environment that hosts excellent potential for the discovery of a larger mineralized feeder system.

In March 2019, the Company entered into an option agreement to acquire a 100% interest in 42 mineral claims known as the Bitter Creek property (the “Original Agreement”) (see news release dated March 6, 2019). Pursuant to the Original Agreement, the Company was to make payments totaling $850,000 in cash or a combination of cash and common shares, in staged payments over 42 months to the vendor (the “Vendor”). Prior to the renegotiation of the Original Agreement, the Company had paid $160,000 in cash to the Vendor.

The Company has now entered into a new agreement with the Vendor (the “Renegotiated Agreement”), which replaces the Original Agreement, whereby the Company will acquire a 100% interest in the Bitter Creek Property, as well as a 100% interest in the Portland claims. The terms of the Renegotiated Agreement call for payments to the Vendor as follows:

- A lump-sum cash payment of $325,000; and

- Issuance to the Vendor of 1,000,000 common shares of the Company.

The Renegotiated Agreement remains subject to approval of the TSX Venture Exchange.

Together, the renegotiation of the Bitter Creek property option agreement, purchase of the Portland claims, and the staking of the Black Hills Extension collectively enhance the entire Cambria project. Renegotiation of the existing Bitter Creek option agreement reduces the total acquisition cost of the ground by eliminating future option payments and alleviates the need for work commitments on select claims. Coupled in the renegotiation of the Bitter Creek property, was the acquisition of the Portland claims (3,622 ha). The outright purchase of both claim groups grants Scottie Resources 100% ownership of the claims, subject to a 2.5% NSR, of which the Company can purchase up to 60% for $1,500,000. The staking of the Black Hills Extension claims bridges a gap between the Black Hills and Bitter Creek West claims, thereby establishing the Cambria project as a single contiguous claims block. Due to operational efficiencies these changes will significantly reduce ongoing land holding costs and G&A expenditures for the Cambria Project.

Sulu Property –

Located 1.5 km northwest of the Scottie Resources’ Summit Lake property, and 7 km NE of the past-producing Granduc Mine, the 1,617 ha Sulu property hosts significant potential for both VMS mineralization and precious metal veins similar to those at the Scottie Gold Mine. An airborne geophysical survey flown on the claims in 2017 produced a number of coincident EM and magnetic anomalies, however the work was never followed up on. Future work on the property will involve ground truthing these anomalies and mapping in areas of significant glacial retreat.

Thomas Mumford, Ph.D., P.Geo and VP Exploration of Scottie, a qualified person under National Instrument 43-101, has reviewed the technical information contained in this news release on behalf of the Company.

Capital Markets Development –

The Company is pleased to announce the addition of Rahim Kassim-Lakha to the role of Head of Corporate Development. Mr. Kassim-Lakha brings a wealth of experience with 25 years of capital market experience including seven years of U.S. buy-side training focused on portfolio management of global assets. Mr. Kassim-Lakha will work closely with Bradley Rourke, CEO and Director of Scottie Resources to lead the Company’s corporate development and capital market activities.

ABOUT SCOTTIE RESOURCES CORP.

Scottie owns a 100% interest in the high-grade, past-producing Scottie Gold Mine and Bow properties and has the option to purchase a 100% interest in Summit Lake claims which are contiguous with the Scottie Gold Mine property. Scottie also owns 100% interest in the Cambria Project properties and the Sulu property.

All of the Company’s properties are located in the area known as the Golden Triangle of British Columbia which is among the world’s most prolific mineralized districts.

Further information on Scottie can be found on the Company’s website at www.scottieresources.com and at www.sedar.com, or by contacting Bradley Rourke, President and CEO at (250) 877-9902.

ON BEHALF OF THE BOARD OF DIRECTORS

“Bradley Rourke”

President & CEO

FORWARD LOOKING STATEMENTS

This news release may contain forward‐looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Although the Company believes the expectations expressed in such forward‐looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward looking statements. Forward‐looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date such statements were made. The Company expressly disclaims any intention or obligation to update or revise any forward‐looking statements whether as a result of new information, future events or otherwise.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of TSX Venture Exchange) accepts responsibility for the adequacy of accuracy of this release.